Wedding Event Liability Insurance

Wedding event liability coverage may cover different things for example bodily injury and property damage.

Wedding event liability insurance. Wedding insurance is an easy way to cover yourself against legal expenses and judgments. Wedding insurance covers you financially in a wide range of circumstances that can happen leading up to the event and even on the big day itself. Bodily injury and property damage liability up to 2 million in coverage available. Our specialty wedding liability insurance protects you against property damage bodily injuries and alcohol related accidents caused by a vendor or guest during the rehearsal dinner wedding ceremony or reception.

You may be held liable for loss of income medical expenses and other damages so purchasing event liability insurance a k a. Wedding liability insurance can help protect you from financial loss if you are held legally responsible for property damage to the venue or bodily injury to someone injured at your event. General liability and cancellation coverage. Wedding event liability insurance liquor liability insurance.

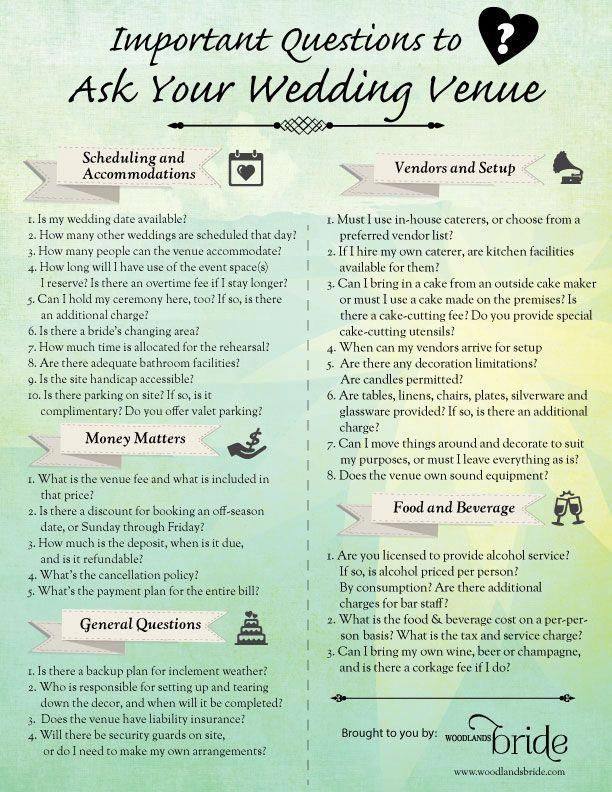

Liability insurance protects you from responsibility from any accidents or injuries during your ceremony or reception. Many of these venues now require event hosts to purchase liability insurance. Event insurance is an important component of planning a successful event regardless of whether you are hosting a wedding or trade show an indoor or outdoor event an event with or without alcohol or a single or multi day event. Before buying wedding insurance always ask the venue if they cover event liability as this provides critical protection for the day of the event.

Event liability insurance protects you if an individual at your event gets injured. If the venue doesn t have coverage you may need to provide your own. Similar to how your car insurance has both liability and comprehensive options wedding insurance typically comes in two flavors. This insurance will not cover postponements or cancellations due to coronavirus.

Most will also require a host liquor liability provision that extends coverage for. Couples today are opting for unconventional wedding venues such as parks museums historic mansions and private estates. This extends to alcohol related incidents. Coverage is for the bride the groom and their parents as well as the venue if requested.

This insurance consists of two different types of policies a special event liability policy and a cancellation or.